A New Stock Market Game that Rewards Patience and Diversification

November 6, 2018

February 27, 2018

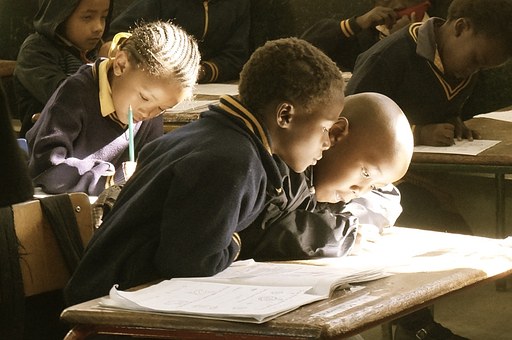

England made financial education mandatory in state-funded schools starting in 2014, and at the time it appeared to be a global leader in the effort to raise financial awareness among young people. Yet since then only 40% of the nation’s students have benefited from such a class, British experts estimate.

The lack of follow through on this trailblazing move illustrates the difficulty that financial literacy advocates confront on a broad scale—in the U.K., in the U.S., and other nations. The central problem is that local school authorities have the real power. Federal directives in this area are often toothless.

In England, the entire school system was in upheaval even before lawmakers voted to require financial literacy instruction. In the last decade, thousands of schools have taken advantage of the country’s “academisation” program, which allows high performing state-funded schools to replace federal authority with local control.

“Now more than 50% of our schools no longer have to follow the curriculum,” Martin Lewis, a prominent voice for school-based financial education in Britain, told a recent gathering. Two-thirds of secondary schools and one in five primary schools have voluntarily converted to “academies,” a classification that grants immense autonomy to individual schools.

But even in schools that have stayed with the national curriculum, financial education has been slow to develop, Lewis says. “No resource or teacher training has been put into it,” he told the audience. Indeed, three quarters of British teachers say the federal mandate for financial literacy in schools has had little or no effect because teachers received no training.

The new setup in England has certain similarities to the U.S., where states control school curriculum. The U.S. government can emphasize direction and influence spending through Department of Education guidelines and funding. But states get the final say in what they teach.

Setting off alarms in U.K. education circles…

• • •

…the academisation program is showing little or no benefit to students. A study focused on students ages seven to 11, showed “no evidence of any performance boost” resulting from the greater autonomy. This means schools are being allowed to opt out of financial literacy—and gaining zero benefit in the long run.

If there is any good news here it is that poor performing British schools may not opt out of the state curriculum. Such schools overwhelmingly serve disadvantaged kids, who tend to need financial education more than their wealthier counterparts. Yet even kids whose families have a little money score poorly in financial literacy assessments. For now, it seems England only checked the box on this important issue.

Free financial literacy learning tools have multiplied in recent years. But few offer cash rewards for playing. Now, NextGen Personal Finance, a nonprofit dedicated to helping personal finance teachers land their message, is doing just that.

NextGen is the co-creator of Payback, a game that helps families sort through the costs of college. It’s partner in the game is McKinney, the brains behind another acclaimed financial literacy game, Spent.

“With just a limited amount of time—less than an hour including a class discussion—you can hone your students’ decision-making skills and hit the key learning objectives for this important topic,” says NextGen founder Tim Ranzetta.

NextGen, a Right About Money sponsor, recently announced the Payback Challenge with up to $150,000 of prize money for teachers and students. The contest is available in 50 states. The contest deadline is March 23. Winners will be announced in April. Only 2,500 teachers will be allowed to register. Here’s how to enter the essay contest:

Gabapentin 300 mg for dogs side effects Teachers must register here. It will take less than a minute.

is neurontin an opiate like lortab Students play Payback. They may do so at home or in class. A single game-play takes 15-20 minutes. Teachers are encouraged to use a full 50-minute period by playing the game twice, leaving some time for discussion too. They may also want use a related classroom activity to reinforce the lessons.

Students write a 250-word essay using this template. The topic: How could you use the online game, Payback, to have a conversation with your parent/guardian about paying for college?

Teacher nominates one essay to be submitted by March 23. Essays will be evaluated by NGPF Staff based on the following criteria: Indicates an understanding of key concepts learned by playing Payback; Addresses concerns parents/guardians may have about this sensitive topic; Takes a creative approach to engaging parents/guardians in a conversation about college.

Essays must be completed by a student currently attending middle or high school. Entries will only be accepted from educators. Essays must be submitted online and must be original and unpublished. Co-authored essays are not accepted.

Ten national grand prizes winners will receive $5,000 each. One hundred-fifty honorable mention winners will receive $500 each. Educators who nominate the Honorable Mention and National Grand Prize Winners will each receive $200 for classroom projects. All educators who nominate a student will be entered into a drawing, where 20 winners will receive $100 each for classroom projects.

Posted in Youth on February, 2018

September 27, 2017

February 28, 2017

October 4, 2017

November 6, 2016