A New Stock Market Game that Rewards Patience and Diversification

November 6, 2018

September 27, 2017

Members of Congress are outraged—outraged! For weeks, they have had clever aids hard at work designing zingers to fire at the disgraced Equifax CEO Richard F. Smith during his scheduled tongue lashing in hearings next week. If only their indignation had manifested pre-emptively, so that millions of consumers understood in the first place how to guard against calamities like the notorious Equifax Breach.

Smith certainly understands acting pre-emptively. This week, he joined two other Equifax top executives on the unemployment line; he retired rather than face lathered-up lawmakers as CEO of a company that knows how to collect sensitive credit information but, as Jerry Seinfeld might say, doesn’t know how to hold sensitive credit information. Some 143 million consumers had their personal information put at risk. Many of them, and millions more, have spent untold hours since the Sept. 7 revelation downloading credit reports and learning how to freeze and unfreeze credit.

You might call that just-in-time financial education, which is all the rage anyway. What’s missing, though, is a level of dispassion and choice that make learning more effective. The Breach forced everyone overboard; freezing credit may be a life raft but you still have to get to shore.

Despite Smith’s departure, Sen. Brian Schatz, Democrat of Hawaii, ordered the former CEO to appear anyway. “A CEO walking out the door just days before he is to appear before Congress is an abdication of his responsibility,” Schatz fumed. His aids must have come up with some choice rhetoric—the better to get a few minutes on CNN. It would be a shame to waste those one-liners.

Yet what does go to waste every day are opportunities for congress to ingrain financial lessons into the lives of youth and adults. Take Sen. Schatz’ home state: Hawaii is among a dozen states that get an F for the way…

• • •

…they promote financial literacy among high school students, according to a ranking from the Center for Financial Literacy at Champlain College. Hawaii is among four states that get an F in a similar ranking released this week by NextGen Personal Finance. That study found that just one in six students is required to take a stand-alone personal finance course to graduate from high school.

Hawaii does not require a personal finance or economic class in high school, or even that one be offered as an elective, according the latest Survey of the States from the Council for Economic Education. Hawaiians rank in the bottom half of states for overall financial literacy, WalletHub found.

Meanwhile, at the federal level the arm of government specifically charged with promoting financial literacy, the Consumer Financial Protection Bureau, is under siege. Many in Congress would love to disarm the agency and fire its director.

Still, while lawmakers were gearing up for a public flogging of Equifax brass (well deserved, by the way), the CFPB this week showed off its commitment to the cause in a new report on financial well-being.

Let’s be clear: the results weren’t terribly surprising. It turns out that people with the most income and education have the highest financial wellness scores. Critically, though, the CFPB found that low-income and lesser educated individuals can achieve equally high financial wellness scores if, among other things, they save just modest amounts of money and stay out of debt.

How can that be? Financial well-being occurs when “a person can fully meet current and ongoing financial obligations, can feel secure in their financial future and is able to make choices that allow them to enjoy life,” the CFPB says. This is a sliding scale achievable across the income spectrum.

The report also shows that formal financial education—learning about things like inflation, compound growth and interest rates—makes a big difference. The point of textbook financial education is to instill financial confidence and promote smart money management, skills that have “strong and positive relationships with financial well-being,” the report states.

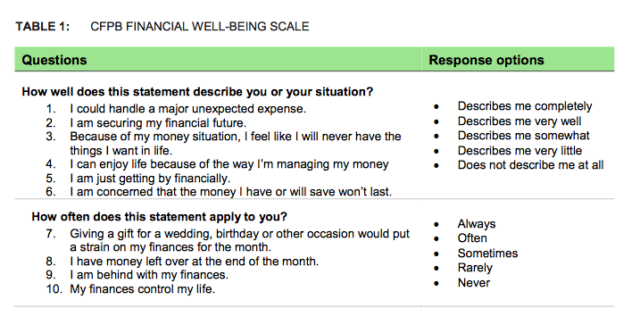

Here are the questions the CFPB asked 6,394 consumers. You might ask yourself, or your students, the same set.

In what was in many ways a banner week for the financial literacy movement, we also got a vague tax proposal from the president–one that points up the ever-changing nature of personal finance–and an academic report further demonstrating the extent to which individuals are on their own in the minefield. On a global scale, the uber wealthy appear distressingly concerned with keeping everything they make. Certainly, some billionaires give freely. But 10% of global economic output–$5.6 trillion—resides in untaxed accounts.

These are not just hedge fund and private equity managers sending their booty offshore. Countries with the largest amount of wealth, relative to GDP, held in tax havens are Israel, Kenya, Kuwait, Russia, Saudi Arabia, United Arab Emirates, Venezuela and Zimbabwe.

Income inequality is a global issue. That includes the U.S., of course, where the share of wealth owned by the top .01% has reached levels last seen when Europe’s emperors ruled the continent. You can almost hear Marie Antoinette cry, “Let them eat cake.”

Yet you need not harken to the 18th century. In a stunningly brazen act, three top Equifax executives sold $1.8 million in stock in the days after The Breach was discovered but before it was disclosed—after which the share price promptly fell by a third.

On one hand, these executives may simply have been practicing what the CFPB study identifies as a top priority for financial well-being: building an emergency fund. Then again, that probably assumes you do it legally.

Rio Verde de Mato Grosso More on States and Financial Literacy:

These States Rank Best and Worst in Financial Literacy

States that Make the Grade in Financial Literacy

Fighting Poverty Through Financial Education in Mississippi

Budget in Shambles, New Mexico Opts Out of Financial Education

Posted in Policy & Government on September, 2017

September 27, 2017

February 28, 2017

October 4, 2017

November 6, 2016